Terms of Service

Welcome to Merit!

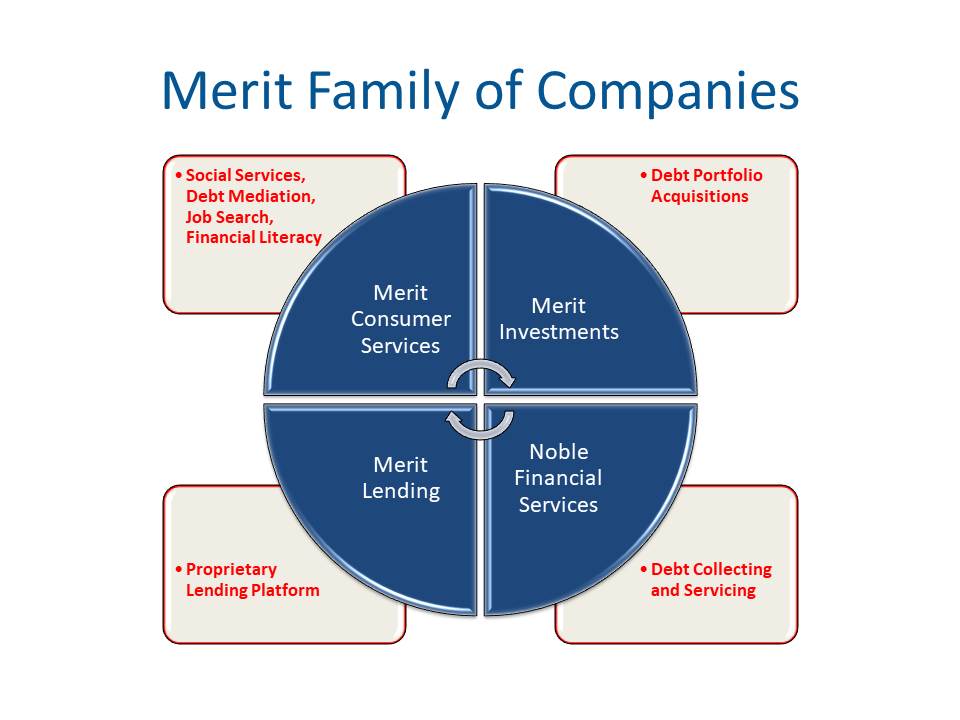

Merit Financial Solutions is an informational program that provides you with financial informational and educational materials, systems, products and tools. Additionally, we may provide you the option to purchase valuable products and services.

PLEASE CAREFULLY REVIEW THESE TERMS OF USE BEFORE USING THE MERIT FINANCIAL WEB SITE OR ANY OTHER WEB SITE OPERATED BY US (COLLECTIVELY, THE “SITES”) OR ANY OF OUR MOBILE APPLICATIONS, OR OBTAINING AND/OR USING ANY OF OUR SERVICES.

BY ACCESSING, BROWSING, OR USING THE SITES OR OUR MOBILE APPLICATIONS OR OUR SERVICES IN ANY WAY YOU AGREE TO ALL OF THESE TERMS.

IF YOU DO NOT AGREE TO BE BOUND BY ALL OF THESE TERMS, PLEASE EXIT THE SITES, OUR MOBILE APPLICATION OR OTHER SERVICES IMMEDIATELY AND DO NOT USE THEM IN ANY WAY.

Merit is a service of Merit Financial Solutions, Inc., an Oklahoma corporation. The following are terms of a legal agreement (the “Agreement”) between you and Merit Financial Solutions, Inc. (“Merit”, “Merit Financial”, “we”, or “us”), that sets forth the terms and conditions for your access to and use of our web and mobile services, including web and mobile Internet sites and mobile applications, including without limitation Internet Web site located at www.MeritFinancialSolutions.com and any other web sites operated by us (collectively, the “Sites”) (however accessed and/or used, whether via personal computers, mobile devices or otherwise) and our Merit mobile application(s) (the “Mobile Application”), which are owned and operated by Merit, and your obtaining from us our services, related analysis of information in connection related to your credit report or debts, related analysis of information and recommendations we may make to you, use of service products or tools, use of career services systems, products or tools, use of social service systems, products or tools, using any informational or educational materials, systems, products or tools available on our sites including the entry of any personal information or uploading any document, and/or offers of products and services from our Partners (such services, the Sites and the Mobile Application shall collectively be referenced as the “Services”).

This Agreement also applies to your use of interactive features or downloads that: (i) we own or control; (ii) are available through the Services; or (iii) interact with the Services and post this Agreement. This Agreement governs your use of the Services. By accessing, browsing, and/or using the Services, you acknowledge that you have read, understood, and agree to be bound by the terms of this Agreement and to comply with all applicable laws and regulations. The terms and conditions of this Agreement form the essential basis of our relationship with you. You should print or save a copy of this Agreement for your records.

The Services contain materials including, without limitation: graphics; layout; text; content; instructions; images; audio; videos; designs; advertising copy; trademarks; logos; domain names; trade names; service marks and trade identities; any and all copyrightable material (including source and object code); the “look and feel” of the Services; the compilation, assembly and arrangement of the materials of the Services; and all other materials related to the Services (collectively, the “Content”). The Services also provide functions and services for which you can register – such as to receive your credit report for free, related analysis of information in connection your credit report or debts, access of debt negotiation systems, products or tools, access of career services systems, products or tools, access of social service systems, products or tools, access of any informational or educational materials, systems, products or tools available on our sites including the entry of any personal information or uploading any document, and, if you so choose, to participate in our other offerings for products, services or referrals to marketing partners program (collectively, the “Product”).

We reserve the right to amend this Agreement from time to time and will notify you of any such changes by posting the revised Agreement on the Sites or on our Mobile Application. You should check this Agreement periodically for changes. All changes shall be effective upon posting. Your continued use of any of our Services after any change to this Agreement constitutes your agreement to be bound by any such changes. We may terminate, suspend, change, or restrict access to all or any part of the Services without notice or liability.

In some instances, both this Agreement and separate governing documents setting forth additional conditions may apply to a particular service or product offered via the Services (“Additional Terms”). The Additional Terms are incorporated by reference into this Agreement. To the extent there is a conflict between this Agreement and any Additional Terms, the Additional Terms will control unless the Additional Terms expressly state otherwise.

1. Account Registration

Through the Services, you may register to receive to use any of the informational or educational materials, systems, products or tools available on our sites, or to obtain valuable offers for products and services from time to time from our partners (collectively, the “Partners”). The decision to provide information to us is purely optional; however, if you elect not to provide such information, you may not be able to access certain features or functions of the Services.

Only users eighteen (18) years of age or older with valid United States Social Security Numbers may participate in our products and services offer program. By registering for an account, you certify that you are eighteen (18) years of age or older.

When you provide information to the Services, you agree to provide only true, accurate, current and complete information about yourself, your family and your accounts and you agree not to misrepresent your identity or your account information. You further agree to keep your account information up to date and accurate. You agree not to register for more than one account or create an account on behalf of someone else.

If you register on the Services and/or create a personal profile, you agree to accept responsibility for all activities that occur under your account or password, and you agree that you will not sell, transfer or assign your account or any account rights. You are responsible for maintaining the confidentiality of your password, and for restricting access to your computer, mobile device, or other Internet access device so that others may not access the password-protected portion of the Services using your name in whole or in part. If you become aware of any unauthorized use of your account, you agree to notify us immediately at the email address UnauthorizedUse@MeritFinancialSolutions.com.

We reserve the right to terminate your account or otherwise deny you access to the Services in our sole discretion, without notice and without liability.

If any information you provide is untrue, inaccurate or not current, or if we have reasonable grounds to suspect that such information is untrue, inaccurate or not current, we, in our sole discretion, have the right to suspend or terminate your use of any Product and refuse all current or future access to the Content and use of the Products or suspend or terminate any portion thereof. Further, you agree that we will not be liable to you or any third party if we suspend or terminate your access to the Content or any Products for any reason. We (and not any of our service providers) own your account information.

2. Specific Consents Granted upon Submission of Your Registration Form

At the time that you submit your registration form to us to register for the Services, you agree that you are providing to us the following specific consents (in addition to being subject to this Agreement):

I understand that by submitting this registration form I am authorizing Merit Financial, to retain information that I may provide from time to time in order to use the Services (collectively, the “Registration Profile”), to use that Registration Profile to match me with product and services offers from time to time from its marketing partners, which offers it will send to me either by e-mail, text message (based upon my communication preferences) or through the display of advertisements or by other means including but not limited to postal services and to further use that Registration Profile to provide statistical analysis, reports and summaries of my Registration Profile in comparison to other users’ Registration Profiles. I understand that Merit Financial will not be sharing my Registration Profile with any of those marketing partners and that it is completely up to me to decide whether I would like to accept any of the offers I receive.

3. ESIGN Consent to Use Electronic Signatures and Records and Disclosure

This E-Sign Disclosure and Consent Notice (“Notice”) applies to all communications, as defined below, for services provided by Merit Financial through the Merit Financial Services. Under this Notice, communications you receive in electronic form from us will be considered “in writing.”

By using Merit Financial’s Services you hereby consent to this Notice and affirm that you have access to the hardware and software requirements identified below. In addition, you must review and accept the terms of these services. If you choose not to consent to this Notice or you withdraw your consent, you will be restricted from using Electronic Services.

COVERED COMMUNICATIONS

May include, but are not limited to, disclosures and communications we provide to you regarding our services such as: (i) terms and conditions, privacy statement or notices and any changes thereto; and (ii) customer service communications (such as communications to and from your creditors through the service) (“Communications”).

METHODS OF PROVIDING COMMUNICATIONS

We may provide Communications to you by email or by making them accessible on the websites, mobile applications, or mobile websites (including via “hyperlinks” provided online and in e-mails). Communications will be provided online and viewable using browser software or PDF files.

HARDWARE AND SOFTWARE REQUIREMENTS

To access and retain electronic Communications, you must have:

- • A valid email address;

- • A computer, mobile, tablet or similar device with internet access and current browser software and computer software that is capable of receiving, accessing, displaying, and either printing or storing Communications received from us in electronic form;

- • Sufficient storage space to save Communications (whether presented online, in e-mails or PDF) or the ability to print Communications.

We may request that you respond to an email to demonstrate you are able to receive these Communications.

HOW TO WITHDRAW YOUR CONSENT

You may withdraw your consent to receive Communications under this Notice by writing to us at Merit Financial Solutions, Inc., Attn: E-Sign Disclosure and Consent Notice, P O Box 690417, Tulsa, OK 74169-0417, or by sending us an email message to Notice@MeritFinancialSolutions.com. Your withdrawal of consent will cancel your agreement to receive electronic Communications, and therefore, your ability to use our Electronic Services.

REQUESTING PAPER COPIES OF ELECTRONIC COMMUNICATIONS

You may request a paper copy of any Communications; we will mail you a copy via U.S. Mail. To request a paper copy, contact us by writing to Merit Financial Solutions, Inc., Attn: E-Sign Disclosure and Consent Notice, P O Box 690417, Tulsa, OK 74169-0417. Please provide your current mailing address so we can process this request. We may charge you a reasonable fee for this service.

UPDATING YOUR CONTACT INFORMATION

It is your responsibility to keep your primary email address current so that we can communicate with you electronically. You understand and agree that if we send you a Communication but you do not receive it because your primary email address on file is incorrect, out of date, blocked by your service provider, or you are otherwise unable to receive electronic Communications, we will be deemed to have provided the Communication to you; however, we may deem your account inactive. You may not be able to transact using our Online Services until we receive a valid, working primary email address from you.

If you use a spam filter or similar software that blocks or re-routes emails from senders not listed in your email address book, we recommend that you add Merit Financial to your email address book so that you can receive Communications by e-mail.

You can update your primary email address or other information by writing to us at Merit Financial Solutions, Inc., Attn: E-Sign Disclosure and Consent Notice, P O Box 690417, Tulsa, OK 74169-0417

FEDERAL LAW

You acknowledge and agree that your consent to electronic Communications is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

TERMINATION/CHANGES

We reserve the right, in our sole discretion, to discontinue the provision of your Communications, or to terminate or change the terms and conditions on which we provide Communications. We will provide you with notice of any such termination or change as required by law.

4. Offers to Purchase Products and Services

We will not share your credit report and/or score or information you provide us about your debts with our Partners. However, we will match offers from Partners against your Registration Profile (as herein defined), which would include your credit report and/or score along with other information you provide to us and other targeting criteria, in order to ensure that you receive offers that are tailored to you.

An integral element of our business objectives is to work to help consumers overcome financial hardship and achieve financial recovery so that their family can be more stable and enjoy the rewards of those efforts, including by receiving discounted and favorable pricing and rates on the products and services that they enjoy. While we do not guarantee that the offers that you receive from our Partners will meet that goal, or that they will necessarily be the best offers available to you, we do represent and warrant to you that providing you with valuable offers for products and services from our Partners is one of the core drivers of our business.

Our technology for matching your Registration Profile and the other information you provide to the offers for products and services provided by our Partners is proprietary and, in carrying out such matching, we may elect to consider, ignore, emphasize, or de-emphasize any relevant factors in our sole discretion. We do not guarantee that you will receive offers for any particular types of products or services.

Any offer for sale or purchase of any product or service by a partner is subject to the terms of sale provisions of the partner offering the particular product or service (including any shopping cart for the particular product or service). We are not responsible for any such transactions or products or services unless we are the vendor, in which case the terms of purchase we have posted for that particular product or service shall apply.

5. Estimates

We may use information you provide to use in order to provide estimates of discounts on your debt balances or for other purposes. We may provide you figures and calculations of possible discounts and/or savings estimates; however, we provide such calculations for illustration purposes only. Such estimated figures are provided based upon our calculations and data only, and are neither endorsed nor commissioned by any of our counter-parties, Partners or third-party advertisers. We do not warrant or guarantee the accuracy, adequacy, timeliness, reliability, completeness or usefulness of any such estimated calculations, and we disclaim liability for errors or omissions in any such estimated calculations.

6. Limitations of Use

NEITHER MERIT FINANCIAL NOR THE PROGRAM IS INTENDED TO PROVIDE LEGAL, TAX OR FINANCIAL ADVICE. MERIT FINANCIAL IS NOT A FINANCIAL PLANNER, BROKER, TAX ADVISOR OR CREDIT COUNSELOR.

The Program is intended only to assist you in your financial organization and decision-making and is broad in scope. Your personal financial situation is unique, and any information and advice obtained through the Program may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.

You agree to use the Services, the Content, and the Products only for lawful purposes. You are prohibited from any use of the Services, the Content, and/or the Products that would constitute a violation of any applicable law, regulation, rule or ordinance of any nationality, state, or locality or of any international law or treaty, or that could give rise to any civil or criminal liability. Any unauthorized use of the Services, including but not limited to, unauthorized entry into Merit Financial’s systems, misuse of passwords, or misuse of any information posted on or available through the Services is strictly prohibited. Your eligibility for particular Products or services is subject to final determination by Merit Financial.

You are solely responsible for your interaction with other users of the Services, whether online or offline. We are not responsible or liable for the conduct of any user. We reserve the right, but have no obligation, to monitor or become involved in disputes between you and other users. Exercise common sense and your best judgment in your interactions with others, when you submit or post any personal or other information, and in all other online activities.

7. Promotions

The Services may contain or offer sweepstakes, contests or other promotions, which may be governed by a separate set of rules that describe the sweepstakes, contest or promotion and may have eligibility requirements, such as certain age or geographic area restrictions. It is your responsibility to read those rules to determine whether or not your participation, registration or entry will be valid and to determine the sponsor’s requirements of you in connection with the applicable sweepstakes, contest or promotion.

8. Intellectual Property Information and Restrictions

Copyright. The copyright in the Content is held by Merit Financial or by the original creator of the material and is protected by U.S. and International copyright laws and treaties. You are permitted to use the Content delivered to you through the Services only on the Services. You agree that the Content may not be copied, reproduced, distributed, republished, displayed, posted or transmitted in any form or by any means, including, but not limited to, electronic, mechanical, photocopying, recording, or otherwise, without the express prior written consent of Merit Financial. You acknowledge that the Content is and shall remain the property of Merit Financial. You may not modify, participate in the sale or transfer of, or create derivative works based on any Content, in whole or in part. The use of the Content on any other web site, including by linking or framing, or in any networked computer environment for any purpose, is prohibited without Merit’s prior written approval. You also may not, without Merit’s written permission, “mirror” any material contained on the Services on any other server. You may not reverse engineer or reverse compile any of the Services’ technologies, including but not limited to, any Java applets associated with the Services. Any unauthorized use of any Content on the Services may violate copyright laws, trademark laws, the laws of privacy and publicity, and communications statutes and regulations.

Trademarks. Merit Financial, MeritFinancial.com, and all related logos (collectively the “Merit Financial Trademarks”) are trademarks or service marks of Merit Financial. Other company, product, and service names and logos used and displayed on the Services may be trademarks or service marks owned by Merit Financial or others. Nothing in the Services should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any of the Merit Financial Trademarks displayed on the Services without our prior written permission in each instance. You may not use, copy, display, distribute, modify or reproduce any of the Merit Financial Trademarks found on the Services unless in accordance with written authorization by us. We prohibit use of any of the Merit Financial Trademarks as part of a link to or from any site unless establishment of such a link is approved in writing by us in advance. Any questions concerning any Merit Financial Trademarks, or whether any mark or logo is a Merit Financial Trademark, should be referred to Merit Financial.

9. Copyright Complaints

• DMCA. You may not use the Sites or Mobile Application(s) for any purpose or in any manner that infringes the rights of any third party. In accordance with the Digital Millennium Copyright Act of 1998 (the “DMCA”) (text at http://www.copyright.gov), Merit Financial has a designated agent for receiving notices of copyright infringement and we follow the notice and take down procedures of the DMCA. We have a policy of terminating the accounts of users who (in our reasonable discretion) are repeat infringers.- • Procedure. If you believe, in good faith, that any materials on Sites or Mobile Application(s) infringe your copyrights, notifications of claimed copyright infringement should be sent to Merit Financial's designated agent as set forth below. Notification should include whenever possible:

- • an electronic or physical signature of the person authorized to act on behalf of the owner of the copyright interest;

- • a description of the copyrighted work that you claim has been infringed;

- • a description of where the material you claim is infringing is located on the Sites or Mobile Application(s);

- • a statement by you that you have a good faith belief that the disputed use is not authorized by the copyright owner, its agent or the law; and

- • a statement by you, made under penalty of perjury, that the above information in your notice is accurate and that you are the copyright owner or duly authorized to act on the copyright owner's behalf.

It is often difficult to determine if your intellectual property rights have been violated. We may request additional information before we remove any infringing material. If a dispute develops as to the correct owner of the rights in question, we reserve the right to remove your content along with that of the alleged infringer pending resolution of the matter.

10. Location of Services and Territorial Restrictions

The information provided by the Services is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Merit Financial to any registration requirement within such jurisdiction or country. Merit Financial controls and operates the Services from offices located in the United States and makes no representations or warranties that the information, products or services provided through the Services are appropriate for use or access in other locations. Anyone using or accessing the Services from other locations does so on his or her own initiative and is responsible for compliance with United States and local laws regarding online conduct and acceptable content, if and to the extent such local laws are applicable. We reserve the right to limit the availability of the Services and/or the provision of any Content, program, Products, service or other feature described or available through the Services to any person, geographic area, or jurisdiction, at any time and in our sole discretion, and to limit the quantities of any such content, program, product, service or other feature that we provide.

11. Notice of Prosecution

Access to and use of password protected and/or secure areas of the Services are restricted to authorized users only. Unauthorized individuals attempting to access these areas of the Services may be subject to prosecution.

Failure to comply with the FCRA can result in state or federal enforcement actions, as well as private lawsuits. In addition, any person who knowingly and willfully obtains a consumer credit report or score/disclosure under false pretenses may face criminal prosecution.

12. Links to Third-Party Sites

There may be links within the Services, or communications you receive through the Services, to third party sites or applications or our Services may include third party content that we do not control, maintain or endorse. We do not control those third party sites or applications or any of the content contained therein and you expressly acknowledge and agree that we are in no way responsible or liable for any of those third party sites or applications, including, without limitation, their content, policies, failures, promotions, products, services, actions and/or any damages, losses, failures or problems caused by, related to or arising from those third parties or their sites or applications. Your correspondence and business dealings with others found on or through the Services, including, without limitation, the payment and delivery of products and services, and any terms, conditions, warranties and representations associated with any such business dealings, are solely between you and the third party. Merit Financial recommends that you review all policies, rules, terms and regulations, including the privacy policy and terms of use of each third party site or application that you visit or use. MERIT FINANCIAL DISCLAIMS ANY HARM THAT MAY RESULT FROM YOUR CHOICE TO USE ANY THIRD PARTY SERVICES, INCLUDING, BUT NOT LIMITED TO, THIRD PARTY SERVICES HOSTED ON THE SITE WHICH MAY ASK TO ACCESS, AND MAY RETAIN, YOUR PERSONAL INFORMATION. YOU AGREE THAT YOUR USE OF THIRD PARTY SERVICES IS AT YOUR OWN RISK.

13. Mobile

• Mobile Features. The Services may offer features and services that are available to you via your mobile phone. These features and services may, include, without limitation, the ability to upload content to the Services, receive messages from the Services, download applications to your mobile phone or access the Service’s features (collectively, the “Mobile Features”). Standard messaging, data and other fees may be charged by your carrier to participate in Mobile Features. Fees and charges will appear on your mobile bill or be deducted from your pre-paid balance. Your carrier may prohibit or restrict certain Mobile Features and certain Mobile Features may be incompatible with your carrier or mobile device. Contact your carrier with questions regarding these issues.- • Terms of Mobile Features. You agree that the Mobile Features for which you are registered may send communications to your mobile device. Further, we may collect information related to your use of the Mobile Features. If you have registered for Mobile Features, you agree to notify us of any changes to your mobile number and update your account on the Services to reflect this change.

14. Items Available for Download

Any items that we make available for download or use from the Services and/or our servers (the “Downloadable Items”) are the copyrighted work of Merit Financial or its licensors or suppliers. Your use of the Downloadable Items may be governed by Additional Terms, which may be included with the Downloadable Items. Please carefully read any Additional Terms to determine the full extent of conditions governing the use of such Downloadable Items. WITHOUT LIMITING THE FOREGOING, COPYING OR REPRODUCTION OF THE DOWNLOADABLE ITEMS TO ANY OTHER SERVER OR LOCATION FOR FURTHER REPRODUCTION OR REDISTRIBUTION IS EXPRESSLY PROHIBITED, UNLESS SUCH REPRODUCTION OR REDISTRIBUTION IS EXPRESSLY PERMITTED BY THE LICENSE AGREEMENT APPLICABLE TO SUCH DOWNLOADABLE ITEMS. Note that if you install certain applications that may be available via the Services, you consent to the download of software to your computer or mobile device and accept these Terms and any Additional Terms related to such application.

15. Rules for Posting Publicly Available Content

As part of the Services, we may allow Registered Users to post content on bulletin boards, blogs and at various other publicly available locations on Merit Financial. You are responsible for all contact you submit to Merit Financial. By submitting content, you grant us a perpetual, worldwide, non-exclusive, royalty-free, sub-licensable and transferable license to use, reproduce, distribute, prepare derivative works of, modify, display, and perform all or any portion of the content in connection with Merit Financial and our business, including without limitation for promoting and redistributing part or all of the site (and derivative works thereof) in any media formats and through any media channels. You also grant each User a non-exclusive license to access your posted content through Merit Financial, and to use, reproduce, distribute, prepare derivative works of, display and perform such content as permitted through the functionality of Merit Financial and under this Agreement.

You may not post any message which is libelous or defamatory, or which discloses private or personal matters about any person. You may not post or transmit any data, image or program that is indecent, obscene, pornographic, harassing, threatening, abusive, hateful, racially or ethnically offensive. You may not encourage conduct that would be considered a criminal offense, give rise to civil liability or violate any law; or that is otherwise inappropriate. You may not post or transmit any message, data, image or program that would violate the property rights of others, including unauthorized copyrighted text, images or programs, trade secrets or other confidential proprietary information, and trademarks or service marks used in an infringing fashion.

You may not interfere with other users’ use of the Services, including, without limitation, disrupting the normal flow of dialogue in an interactive area of Merit Financial, deleting or revising any content posted by another person or entity, or taking any action that imposes a disproportionate burden on the Merit Financial infrastructure or that negatively affects the availability of Merit Financial to others. Except where expressly permitted, you may not post or transmit charity requests, petitions for signatures, franchises, distributorship, sales representative agency arrangements, or other business opportunities (including offers of employment or contracting arrangements), club memberships, chain letters, or letters relating to pyramid schemes. You may not post or transmit any advertising, promotional materials or any other solicitation of other users to use goods or services except in those areas that are specifically designated for such purpose.

16. Access and Interference

You agree that you will not use any robot, spider, scraper, deep link or other similar automated data gathering or extraction tools or program, algorithm or methodology to access, acquire, copy or monitor Merit Financial or any portion of Merit Financial without our express written consent, which may be withheld in our sole discretion. You agree that you will not use or attempt to use any engine, software, tool, agent, or other device or mechanism (including without limitation browsers, spiders, robots, avatars or intelligent agents) to navigate or search Merit Financial, other than generally available third-party web browsers. You agree that you will not post or transmit any file which contains viruses, worms, Trojan horses or any other contaminating or destructive features, or that otherwise interfere with the proper working of Merit Financial. You agree not to attempt to decipher, decompile, disassemble, or reverse-engineer any of the software comprising or in any way making up a part of Merit Financial.

17. Disclaimer of Warranties

None of Merit Financial, any of its affiliates, agents, and service providers, and each of their respective officers, directors, members, shareholders, employees, agents, vendors, independent contractors or licensors (collectively the “MERIT FINANCIAL PARTIES”) guarantees the accuracy, adequacy, timeliness, reliability, completeness, or usefulness of any of the content and the MERIT FINANCIAL PARTIES disclaim liability for errors or omissions in the content, the products or the services. With respect to the Products (including, without limitation, free credit scores, free job search assistance, free debt negotiation assistance, free social services assistance, free financial literacy tools and applications, valuable offers for products and services from our partners, and estimated calculations of savings that might result from debt negotiation or transferring your credit card balance to another credit card or lender), you hereby acknowledge your understanding that Merit Financial is solely an intermediary between you and the national reporting agency actually furnishing the credit scores (in the case of free credit scores), between you and a prospective employer (in the case of job search assistance), between you and your lender (in the case of debt negotiation services), between you and a public or private social service agency (in the case of social service assistance, and between you and our partners (in the case of offers for products and services), and that our calculations of possible savings or benefits is merely an estimate; therefore, the MERIT FINANCIAL PARTIES hereby expressly disclaim any liability for the inaccuracy or incompleteness of any information provided or for the content, availability, or legality of any of the offers made by the partners, or of its estimated calculations of savings or benefit or any transaction or business.

The Services and all of the Content and Products are provided “as is” and “as available” and “with all faults” basis. To the fullest extent permissible by law, the MERIT FINANCIAL PARTIES make no representations, warranties or endorsements of any kind whatsoever, express or implied, as to: (a) the sites, the mobile application(s) and any other Services, (b) the Content, (c) the Products, (d) the downloadable items, (e) user content, (f) security associated with the transmission of information transmitted to or from Merit Financial or via the Services. The MERIT FINANCIAL PARTIES further make no representations, warranties or endorsements that (i) the services will meet your requirements; (ii) the services will be uninterrupted, timely, secure or error-free; (iii) the quality of any of the Content, the Products or the Services, information or other material obtained by you through the services will meet your expectations; or (iv) any errors in technology will be corrected. In addition, the MERIT FINANCIAL PARTIES hereby disclaim all warranties, express or implied, including, without limitation, the warranties of merchantability, fitness for a particular purpose, non-infringement, title, custom, trade, quite enjoyment, system integration and freedom from computer virus. Additionally, there are no warranties as to the results of your use of the services, the content or the products. This does not affect those warranties which are incapable of exclusion, restriction or modification under the laws applicable to this agreement.

Any material downloaded or otherwise obtained through use of the Services is done at your own discretion and risk and you are solely responsible for all damages to your computer system or mobile devices or loss of data that results from the download of such material. No advice or information, whether oral or written, obtained by you from the MERIT FINANCIAL PARTIES will create any warranty not expressly stated in these terms.

Merit Financial may discontinue or make changes in the Services, the Content, and/or the Products at any time without prior notice to you and without any liability to you or any third party. Any dated information is published as of its date only, and the MERIT FINANCIAL PARTIES do not undertake any obligation or responsibility to update or amend and such information. We reserve the right to terminate any or all services offerings or transmissions without prior notice to you. The Services could contain technical inaccuracies or typographical errors. Use of the Services is at your own risk.

18. Disclaimer and Limitation of Liability

Under no circumstances will the MERIT FINANCIAL PARTIES be liable for any loss or damages including, without limitation, general, special, direct, indirect, incidental, consequential, punitive or any other damages (including, without limitation, loss of profits, loss of goodwill, loss of use, loss of data, business interruption, or other intangible losses) of any kind whether in an action in contract or negligence, even if the MERIT FINANCIAL PARTIES, or representatives thereof, are or were advised of the possibility of such damages, losses or expenses, arising or relating in any way to: (a) the use or inability to use by any party of the Services, the content, the products, or any third-party site to which the Services is linked; (b) in connection with any failure or performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or line or system failure; (c) the cost of getting substitute goods or services; (d) any products, data, information or Services purchased or obtained or messages received or transactions entered into, through or from the Services; (e) unauthorized access to or alteration of your transmissions or data; (f) statements or conduct of anyone on the Services; (g) the use, inability to use, unauthorized use, performance or non-performance of any third party provider site, even if the provider has been advised of the possibility of such damages; or (h) any other matter relating to the Services. The MERIT FINANCIAL PARTIES are not liable for any defamatory, offensive or illegal conduct of any user. Your sole remedy for dissatisfaction with the Services, the content, and/or the products is to stop using the Services and to notify us that you no longer desire to receive the Products. If your use of the Services, the Content, and/or the Products results in the need for servicing, repair or correction of equipment or data, you assume any costs thereof.

In no event will the MERIT FINANCIAL PARTIES’ total liability to you for all damages, losses or causes of action of any kind or nature whatsoever exceed Ten United States Dollars (.00 USD).

If any of the foregoing limitations are found to be invalid, you agree that the MERIT FINANCIAL PARTIES’ total liability for all damages, losses, or causes of action of any kind or nature whatsoever shall be limited to the greatest extent permitted by applicable law.

Your access to and use of the Services is at your risk. If you are dissatisfied with the Services or any of the Content or the Product, your sole and exclusive remedy is to discontinue accessing and using the Services.

WAIVER OF UNKNOWN CLAIMS. By accessing the Services, you understand that you may be waiving rights with respect to claims that are at this time unknown or unsuspected, and in accordance with such waiver, you acknowledge that you understand, and hereby expressly waive, the benefits of law of any state which provides that a general release does not extend to claims which the Creditor does not know of or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the Debtor.

19. Monitoring of the Services

We have no obligation to monitor the Services; however, you acknowledge and agree that we have the right to monitor the Services electronically from time to time and to disclose any information as necessary or appropriate to satisfy any law, regulation or other governmental request, to operate the Services, or to protect itself or other users of the Services.

20. Security Features

Because we use security measures designed to protect your privacy and to safeguard your information, we may not always be able to successfully provide our Products to you, so we do not guarantee or warrant that we will be able to provide any such Products to you, even if you submit a registration form to us for such Products. We may use your personal information to the extent necessary to process your order and carry out the transactions that you enter into with us.

21. Governing Law and Dispute Resolution

This Agreement shall be subject to and construed under the laws of the State of Oklahoma, without reference to the conflicts of law provisions thereof.

You understand and agree that all claims, disagreements, disputes or controversies between you and Merit Financial, and its officers, directors, employees, representatives, agents, parents, affiliates, subsidiaries and/or related companies, including related to the Services, shall be resolved by final and binding arbitration. Because the Services provided to you by Merit Financial concern interstate commerce, the Federal Arbitration Act (“FAA”) governs the arbitrability of all disputes. However, applicable federal or state law may also apply to the substance of any disputes. The arbitration shall take place in Tulsa, Oklahoma. The arbitration shall be administered by the American Arbitration Association (“AAA”) in accordance with Title 9 of the US Code (United States Arbitration Act) under the AAA’s Commercial Dispute Resolution Procedures as supplemented by the Supplementary Procedures for Consumer-Related Disputes (and as stated therein, if there is a difference between the Commercial Dispute Resolution Procedures and the Supplementary Procedures, the Supplementary Procedures will be used). Neither you nor we shall be entitled to join or consolidate claims in arbitration by or against other users/consumers or arbitrate any claim as a representative or member of a class or in a private attorney general capacity. The parties voluntarily and knowingly waive any right they have to a jury trial.

NO CLASS ACTIONS. To the fullest extent permitted by applicable law, you agree that any and all disputes, claims and causes of action you may against Merit Financial in connection with or related to the Services will be resolved individually, without resort to any form of class action.

22. Termination

This Agreement is effective until terminated by either you or Merit Financial as set out below.

If you want to terminate your legal Agreement with Merit Financial, you may do so by notifying Merit Financial in writing. Your notice should be sent, in writing, to Merit Financial Solutions, Inc. at PO Box 690417, Tulsa, OK 74169-0417 and include your name, date of birth, and email address for your Merit Financial account. You may also terminate your account online at the Merit Financial website.

Merit Financial may terminate this Agreement at any time without notice, or suspend or terminate your access and use of the Services, the Content, and/or the Products at any time, with or without cause, in Merit Financial's absolute discretion and without notice.

The following section of this Agreement shall survive termination of your use or access to the Services: sections 3, 4, 5, 6, 7, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 25 and 26, and any other provision that by its terms or by its nature survives or should survive termination of your use or access to the Services, the Content, and/or the Products.

23. Indemnification

You agree to defend (if requested by Merit Financial) indemnify and hold harmless the MERIT FINANCIAL PARTIES from and against any and all claims, losses, expenses, demands or liabilities, including attorneys' fees and costs, incurred by the MERIT FINANCIAL PARTIES in connection with any claim by a third party (including any intellectual property claim) arising out of: (A) your use of the Services, the Content, and/or the Products; (B) your violation or alleged violation of this Agreement; (C) your violation or alleged violation of any applicable law or regulation, or (D) your infringement or alleged infringement by of any intellectual property or other right of any other person or entity. You further agree that you will cooperate fully in the defense of any such claims. The MERIT FINANCIAL PARTIES reserve the right, at their own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification by you, and you shall not in any event settle any such claim or matter without the written consent of Merit Financial.

24. Miscellaneous

This Agreement constitutes the entire agreement between Merit Financial and you in connection with your use of the Services, the Content and/or the Products, your receipt of your free credit report or score, and your participation in our program to receive periodic offers for products and services from our Partners and supersede any prior versions of our Terms of Use (or similar documents), if applicable. The failure of Merit Financial to enforce any of its rights or act with respect to a breach of this Agreement by you or others does not constitute a waiver and will not limit Merit Financial’s rights with respect to such breach or any subsequent breaches. No waiver by Merit Financial of any of the provisions in this Agreement will be of any force or effect unless made in writing and signed by a duly authorized officer of Merit Financial. Neither the course of conduct between the parties nor trade practice will act to modify this Agreement. Merit Financial may assign its rights and duties under this Agreement to any party at any time without any notice to you. This Agreement may not be assigned by you without Merit Financial’s prior written consent. You agree that Merit Financial’s agents and service providers are third-party beneficiaries of this Agreement, with all rights to enforce provisions of this Agreement applicable to them as if those agents and service providers were a party to this Agreement. If any provision of this Agreement will be unlawful, void, or for any reason unenforceable, then that provision will be deemed severable from the Agreement and will not affect the validity and enforceability of any remaining provisions. The Section titles are inserted only as a matter of convenience and have no legal or contractual effect. You agree that this Agreement will not be construed against Merit Financial by virtue of having drafted them.

25. Contacting Us

If you have questions regarding this Agreement or the practices of Merit Financial, please contact us by e-mail at Legal@MeritFinancialSolutions.com or by regular mail at Merit Financial Solutions, Inc., PO Box 690417, Tulsa, OK 74169-0417, Attention: Legal Department.